- Home

- Live Blog

- Breaking News

- Top Headlines

- Cities

- NE News

- Sentinel Media

- Sports

- Education

- Jobs

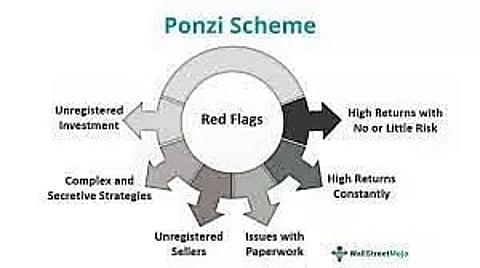

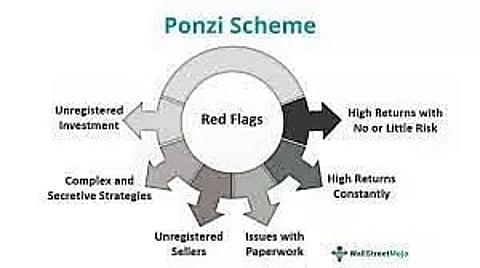

New Delhi: A Ponzi scheme is a fraudulent investment scam, promising investors high rates of return with low risk. A Ponzi scheme is a fraudulent investment scam that generates returns for earlier investors by taking money from subsequent investors.

In simple words, it is a type of pyramid scheme, based on the use of funds from new investors to pay off previous investors.

Both Ponzi and pyramid schemes gradually come to an end when the influx of new investors ends and they have no money to blow. Only then do such schemes get exposed.

-- Like pyramid schemes, Ponzi schemes generate returns for old investors by getting new investors who have been promised higher returns without any risk.

-- Both fraudulent arrangements are based on the use of funds from new investors to earlier investors.

-- Companies that are involved in Ponzi schemes focus all their energy on attracting new customers to invest.

A Ponzi scheme is an investment fund, which promises its customers huge returns without any risk. This new income is used to pay their returns to the original investors, which are recognized as profits from legitimate transactions. Ponzi schemes rely on a steady flow of new investments to keep providing returns to old investors. When the flow of this fund dries up, the scheme dies.

The term 'Ponzi scheme' was coined in 1919 after Charles Ponzi, a fraudster who duped thousands of investors. Charles Ponzi's original scheme focused on the US Postal Service. It was given this name because of the use of postage stamp scheme-related investments elsewhere.

Also read: POSITIVE SENTIMENTS: Valuations to attract interest in equities

Also watch: